For quite a while, real estate agents (myself included) have held the opinion that property values are inflated. After all, how does one explain the incredible price increases over the past two years and bidding wars we see on single family homes in some markets? I attended a Keller Williams Realty meeting Friday in which it was shown that in the greater Asheville, NC area, single family homes have appreciated an average of 18% over the past twelve months. Surely we’re in a bubble, right? Surely prices will plummet soon enough due to higher interest rates, the war in Europe, etc., right?

Well, maybe but maybe not.

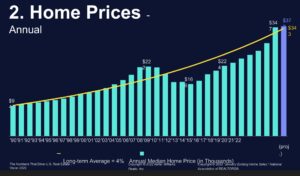

Historically in the United States going back nearly 60 years, the average appreciation rate for single family homes has been around 4%. The graph to the right shows a yellow line that tracks home prices on a 4% appreciation rate against the actual median price. Look carefully and you’ll see that the median price today is actually on par with an average 4% appreciation rate. One reason so many of us claim housing prices are in bubble territory is that we’re going off the lows of 2008 – 2010.

In the immediate years prior to 2008, home prices were in fact in bubble territory, having escalated rapidly due in part to large speculative buying and loose lending practices. But during the Great Recession of 2008, home prices fell dramatically. After several years of slow appreciation, only recently have prices climbed rapidly. But even though they’ve climbed like a rocket in the past two years, the median home price is right in line with an annual 4% appreciation rate. In looking at this chart, home prices are exactly where actuaries of 20 years ago would have predicted them to be today.

Couple that with the fact that after 2008, new housing starts plummeted for years and have yet to catch up to demand. Though interest rates are now at 5% for a fixed rate loan, rates are still very low, and mortgage payments are equal to or lower than rent payments. Therefore, the prognosis for continued price increases is actually surprisingly positive. I would not have imagined it to be that way, but those are the numbers. Of course a “black swan” event could throw all this out the window. What’s a “black swan” event? That is something totally out of the blue that throws the economy into turmoil (think war, terrorist attack, pandemic, massive food shortages, etc.). So barring such an event, things may continue onward for quite a while.

What that means for mountain real estate is that demand continues to grow. Inventory for good quality homesteads and bugout properties continues to be tight. In the past week, I’ve had two buyer clients having to submit backup offers on properties they were after because someone else beat them to the properties. These properties had only been on the market for a few days and went to contract almost immediately. So if you find a property that is a good fit, be prepared to move on it quickly and forcefully. Call us today to help you in securing your ideal piece of our western North Carolina mountains.